...and it doesn't include working!

during my lunch break i decided to stray from my normal routine of grabbing whatever my company offers (yes, we get free lunch) and heading downstairs to talk isht with my co-workers, and decided to make the 5 minute drive to santa monica's 3rd street promenade.

since graduating from college I have forgotten what summer "on the outside" looks like. when i lived in NYC i used to go outside every day during lunch and walk around, but never too far because i had to be back in the office. now, back in cali, nothing is really within walking distance and it is usually too much of a hassle to drive somewhere, maybe get stuck in traffic, then try to find a parking space, so i usually stay here at the building. but not today. this is my last week here (yes, it's official) so i'm a little more bold, not caring if i get back EXCATLY at 1pm (bad Cents *slaps hand*). so, i broke out in search of some fresh air. at the promenade i browsed the Apple Mac store (please God, send me a black Mac Book!), i browsed old navy, J crew, Express, and B&N. i watched mommies and nannies push babies around in their Maclaren & Peg Prego strollers....and it hit me...

THIS is what i want!

i want to be able to push my son around in his stroller with a strawberries and cream frappuccino in one hand and a few shopping bags in the other. i want to be able to take him to the park, to the beach, to the movies, anywhere...and feel confident that mommy has enough money to buy him (or herself) a little something. this life i want for myself is not about money, but more about comfort. knowing that you are financially secure and able to enjoy it is priceless.

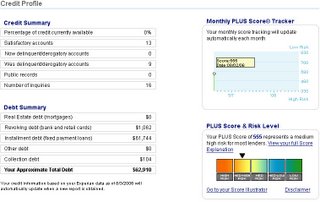

for too long i have operated on the starving student level. four years after undergrad, a year out of grad school, a baby and a soulmate later, i'm too old to play that role any more. i don't want to decide between paying the rent or the car note. i don't want to juggle bills, don't want to worry about answering my phone for fear it’s a collection agent, and i don't want to have to pass up those cute shoes when i see them.

i've thought about this life for a while now and i've come to realize that it's not going to happen without a serious income. and I’ve also realized i'm not going to make that income doing only what i do now. so the side hustle hunt has begun. getting free financially is not only about paying off my debt, but also building wealth and enjoying it. i don't want to work for someone else for the rest of my life. hell, i don't want to be working 5 or 10 years from now. but if i can work hard on my "normal" job, and hustle (legally) on the side, then i might just be able to reach the promised land sooner than I think.

ps: anyone with an legit work from home type moneymakers holla at me:

countingmypennies@gmail.com.

peace