(click on image for larger image)

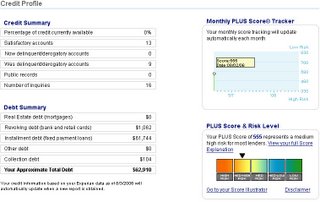

after tracking my spending for a minute (i know, i know...i still need to keep tracking), i decided to pull my credit report. i called to get my reports from all of the agencies (for free!), but me being me (read: impatient), i logged onto FreeCredit.com to get my credit report and score. according to FreeCredit (run by experian) my credit score is 555, which is "poor." this gives me hope because it has gone up since i last checked! i've gone from "very poor" to "poor" (lol) and slow motion is better than no motion.

breaking down the report...

my report indicated that i have 9 negative items and 13 satisfactory accounts. according to the score breakdown i can raise my score if i open a credit card and make all of the payments on time, so i'm going to open a secured card and work with that to raise my score. as far as the negatives....i'm open (suggestions?)...i want to get those joints off of my report (in time for apartment hunting). i've been scouring the Credit Boards site to find solutions, but it's very overwhelming (still). i'm going to stay on it though, i'm not in as bad of shape as i once thought, and that is very very good news.

peace

4 comments:

You have taken a good first step. Getting your credit report is good so that you can deal with the items that are on there. Remember the first thing to do is dispute any errors. Another critical thing is to make sure your personal information is correct such as name spelling, address, employment etc.

yeah, there are a lot of things wrong. it lists like 3 names for me, 2 of which aren't right. it list the wrong birth date & SSN, and like 5 different addresses. all of which i'm going to ask them to clear up and remove.

Oh no. That is serious with the birthate and SSN being wrong. Stay on top of them and make sure they get it corrected. This can spell further trouble.

I just enrolled my boyfriend in a debt settlement program with DTS Financial (www.debteliminators.com). I found out about them because my best friend and another close friend of ours used them and they are both almost debt free just 2-3 years later. Basically, they negotiate with the credit card companies on your behalf to settle for a lower amount than your current balance, and DTS pays off the credit card companies. Then you open a trust account through DTS's 3rd party (Noteworld) and they make withdrawals from your account to pay themselves. They take a 25% cut of the money they save you. That's how they make their money. It's a great deal. Mike has $35,000 in CC debt, and he now pays $528 per month for 40 months or less. In the end, he will only pay the CC companies about $20,000, with about $2,000 going to DTS for their fees. It's really saving us. He used to pay $900-1,000/month to CC's.

We've been using them for 3 months now and they are very honest and reliable. The only catch is that you can't use the credit cards anymore (the ones that you are trying to settle, because they close the accounts for you when settling) and they only allow you to keep 1 credit card. But that's good for you because it breaks the cycle of debt. It's been hard to live without credit cards, but we're managing somehow. Let me know if you want any more info on them. If you decide to sign up with them, message me and I'll give you my name (they give you bonuses for referrals.)

Wow, that was a long post. Thanks for visiting my site!

Post a Comment